Choosing the right rental insurance policy can be a daunting task, but it’s a crucial step in protecting your belongings and yourself from financial liability. Whether you live in an apartment, condo, or rental home, understanding how to navigate the world of renters insurance is essential. This comprehensive guide will equip you with the knowledge necessary to select the best renters insurance policy that fits your specific needs and budget. We’ll explore key factors to consider, such as coverage types, policy limits, and deductible options, empowering you to make informed decisions about your rental insurance coverage.

From understanding what rental insurance covers to comparing quotes and choosing the right provider, this article will break down the process step-by-step. We’ll delve into the importance of personal property coverage, liability protection, and additional living expenses coverage, helping you determine the appropriate levels of protection. By the end of this guide, you’ll be well-prepared to secure the best rental insurance policy to safeguard your possessions and finances against unexpected events, giving you peace of mind in your rented space. Don’t underestimate the value of renters insurance – it’s a worthwhile investment for every renter.

Understand Types of Rental Insurance

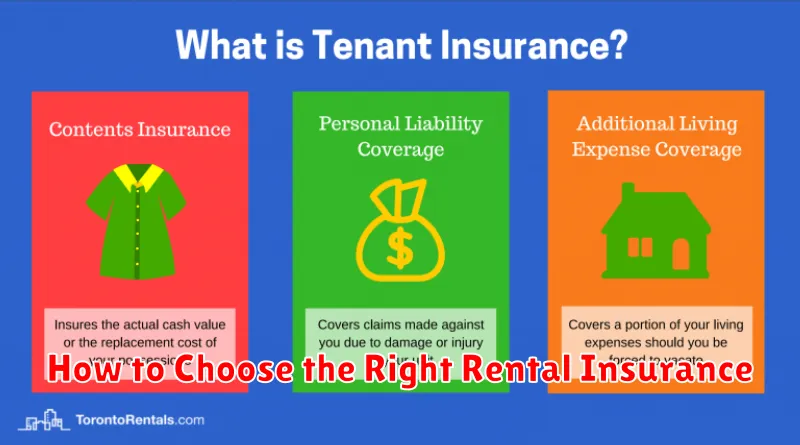

Before selecting a policy, it’s crucial to understand the different types of rental insurance available. There are several key coverage options to consider, each protecting different aspects of your belongings and liability.

Personal Property Coverage

This coverage protects your personal belongings, such as furniture, electronics, and clothing, from covered perils like fire, theft, and vandalism. The amount of coverage you need depends on the value of your possessions. Create a home inventory to accurately assess this value.

Liability Coverage

Liability coverage protects you financially if someone is injured in your rented home or if you accidentally damage someone else’s property. It covers medical expenses and legal fees. Choosing sufficient liability coverage is essential to protect your assets.

Additional Living Expenses (ALE) Coverage

If a covered event makes your rental uninhabitable, ALE coverage helps pay for temporary housing, food, and other essential living expenses. Consider your potential relocation costs when selecting ALE coverage.

Coverage Differences and Benefits

Understanding the nuances of different coverage options is crucial for selecting the right rental insurance policy. Policies typically offer variations in coverage for personal property, liability protection, and additional living expenses.

Personal property coverage protects your belongings against perils like fire, theft, and vandalism. The coverage amount should reflect the replacement value of your possessions. Consider higher coverage limits if you own valuable items.

Liability coverage protects you financially if someone is injured in your rental unit or if you accidentally damage someone else’s property. It covers legal fees and medical expenses. Choose adequate coverage to protect your assets.

Additional living expenses (ALE) coverage reimburses you for temporary housing and other necessary costs if your rental becomes uninhabitable due to a covered peril. The coverage amount should be sufficient to maintain your standard of living.

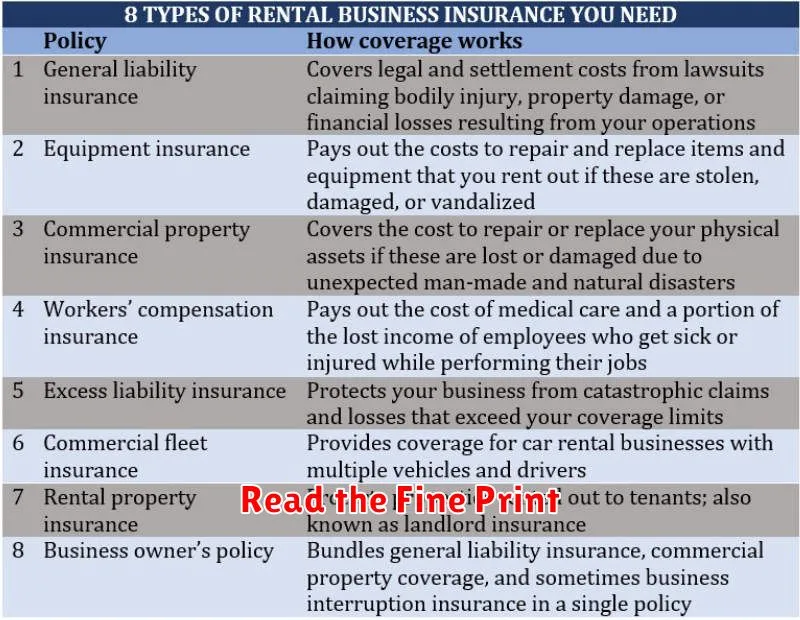

Read the Fine Print

Before signing any rental insurance policy, it’s crucial to thoroughly review the policy details. Insurance policies can be complex, and overlooking key details can lead to unexpected surprises when you need to file a claim.

Pay close attention to the coverage limits for your personal belongings. Does the policy offer enough coverage to replace everything you own in case of a total loss? Consider creating a home inventory to accurately assess the value of your possessions.

Also, understand the deductible. This is the amount you’ll have to pay out-of-pocket before your insurance coverage kicks in. A lower deductible typically means a higher premium, so you’ll need to find a balance that works for your budget.

Finally, be aware of any exclusions. These are specific events or items that are not covered by the policy. Common exclusions may include flood damage or certain high-value items like jewelry or artwork. You may need to purchase additional coverage for these items.

Check with Your Credit Card Provider

Before purchasing a separate rental insurance policy, it’s wise to check with your credit card company. Some credit cards offer rental car insurance as a built-in perk. This coverage can sometimes provide similar protections to a traditional policy, potentially saving you money.

Contact your credit card provider to inquire about rental car coverage benefits. Ask about specific details, such as the types of damage covered (collision, theft, liability), coverage limits, and any requirements or restrictions that may apply. Be sure to clarify if the coverage is primary or secondary. Primary coverage means your credit card’s insurance pays first. Secondary coverage means it only pays after your personal auto insurance policy.

Understanding your credit card benefits can help you make an informed decision about whether you need to purchase additional rental insurance.

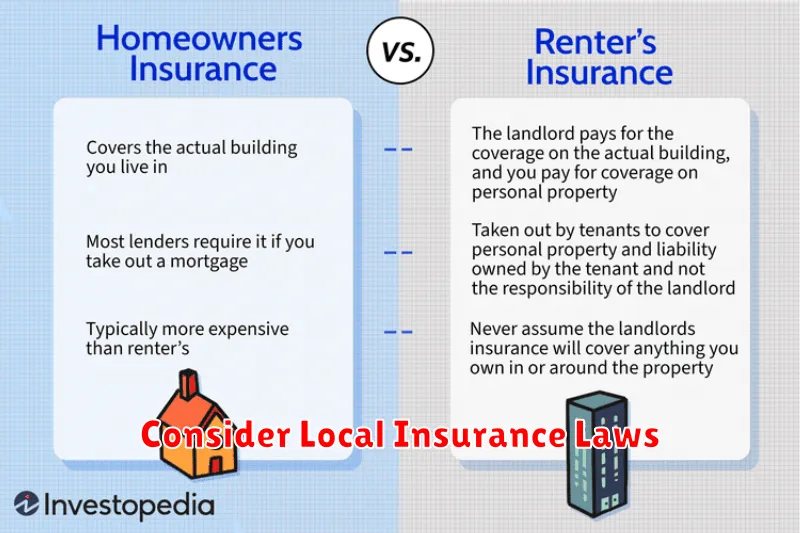

Consider Local Insurance Laws

Rental insurance regulations vary by location. Understanding your local laws is crucial for selecting appropriate coverage. Some areas may mandate specific minimum coverage amounts for liability or personal property protection. Others might have specific regulations regarding coverage for natural disasters common to the region, such as floods or earthquakes.

Researching your local laws can help you avoid penalties and ensure you have adequate protection. Contact your state’s insurance department or consult with a licensed insurance professional for guidance on specific legal requirements in your area. This will allow you to make informed decisions about your coverage needs and avoid potential legal issues.

Compare Offers Before Booking

Once you’ve gathered quotes from multiple insurance providers, carefully compare the offers. Don’t just focus on the premium price. A lower premium might mean less coverage. Thoroughly examine the coverage details.

Pay close attention to the policy limits for personal belongings, liability coverage, and additional living expenses. Consider factors like deductibles, which are the amounts you pay out-of-pocket before the insurance kicks in. A higher deductible usually means a lower premium, but you’ll pay more if you need to file a claim.

Look for any exclusions or limitations in the policies. Some policies may not cover certain types of damage or events. Understanding these limitations is crucial to selecting the right coverage for your needs. Also, consider the reputation and financial stability of the insurance providers. Choose a reputable company with a strong track record of paying out claims.

Avoid Duplicate Coverage

Before purchasing a separate renters insurance policy, carefully review your existing insurance policies. You may already have some coverage through other policies, such as your auto insurance or homeowner’s insurance (if you own a secondary property). Understanding your existing coverage can help you avoid paying for redundant protection.

For example, your auto insurance policy might cover personal belongings stolen from your car. If this is the case, ensure your renters insurance doesn’t duplicate this coverage to optimize your premium costs.

Common areas of overlap include personal property coverage, liability protection, and additional living expenses. Consult with your insurance provider(s) to clarify what is and isn’t covered under your existing policies. This can help you tailor your renters insurance to fill any gaps and avoid unnecessary expenses.