Navigating the world of rentals can be challenging, especially when it comes to understanding rental deposits and refunds. This article provides a comprehensive guide to rental deposits, covering everything from what they are and why they’re required, to how to ensure you receive your refund when you move out. Whether you’re a first-time renter or a seasoned tenant, understanding your rights and responsibilities regarding security deposits is crucial. We’ll delve into the legalities surrounding deposit amounts, permissible deductions, and the process for disputing unfair charges, empowering you to protect your finances throughout your tenancy.

From security deposits to pet deposits, and cleaning deposits, this guide clarifies the different types of rental deposits and what they cover. We’ll discuss lease agreements, move-in inspections, and move-out inspections, explaining how these processes impact your deposit refund. We’ll also offer practical advice on documenting the condition of your rental unit and communicating effectively with your landlord to maximize your chances of receiving a full refund. This comprehensive understanding of rental deposits and refunds will equip you to confidently enter and exit your next rental agreement.

What Is a Rental Deposit?

A rental deposit is a sum of money paid by a tenant to a landlord at the beginning of a lease agreement. It acts as a form of financial security for the landlord against potential damages to the property or unpaid rent. This deposit is typically held in a separate account and is not considered part of the landlord’s income unless it is forfeited due to breaches in the lease agreement.

There are various types of rental deposits, the most common being a security deposit. Other types may include pet deposits, cleaning deposits, or key deposits, depending on the specific terms of the lease. The amount of the deposit can vary depending on local laws, the rental market, and the condition of the property. It’s crucial to understand the specifics of your deposit as outlined in your lease agreement.

Common Deposit Policies

Understanding deposit policies is crucial for both landlords and tenants. These policies outline the terms and conditions surrounding the security deposit, a sum paid by the tenant to protect the landlord against potential damages or unpaid rent.

Types of Deposits

Security Deposits: The most common type, used to cover damages beyond normal wear and tear, and unpaid rent. Landlords often specify a maximum limit, often one or two months’ rent.

Pet Deposits: Charged for tenants with pets, covering potential pet-related damages. These may be refundable or non-refundable.

Cleaning Deposits: Intended to cover the cost of cleaning the unit upon the tenant’s departure. Similar to pet deposits, these can be refundable or non-refundable.

Key Policy Considerations

Deposit Amount: Policies should clearly state the total deposit amount and how it’s divided (if applicable, e.g., between pet and security deposits).

Documentation: A move-in/move-out inspection is highly recommended. This documented condition report protects both parties by providing evidence of the unit’s state at the beginning and end of the tenancy.

Refund Process: Policies must specify the timeline for returning the deposit after the tenant vacates. It should also detail how deductions will be calculated and communicated to the tenant.

How to Ensure Full Refund

Securing a full refund of your rental deposit requires diligent action throughout your tenancy. Carefully document the condition of the property upon move-in, noting any existing damage with photos and a written report shared with your landlord. This establishes a baseline against which the property’s condition will be assessed at move-out.

Adhere to the terms of your lease agreement. Pay rent on time and fulfill all your responsibilities as a tenant. Address any maintenance issues promptly and communicate effectively with your landlord regarding repairs.

Prior to move-out, thoroughly clean the property, including appliances, bathrooms, and floors. Repair any minor damages you are responsible for, such as patching small holes in the walls. Document the clean and repaired state of the property with photos.

Finally, conduct a joint inspection with your landlord at move-out. This allows for open communication and agreement on the property’s condition. Address any discrepancies immediately. A well-documented move-out process significantly increases your chances of receiving a full refund of your security deposit.

Documenting Property Condition

Thoroughly documenting the property’s condition is crucial for both landlords and tenants. This documentation serves as a baseline to assess any damages beyond normal wear and tear at the end of the tenancy.

A comprehensive record should include the following:

- Written Report: A detailed description of the property’s condition, noting any existing damage.

- Photographs: Clear photos of each room, appliances, and any existing damage.

- Video Walkthrough: An optional but valuable tool to provide a comprehensive visual record.

Both parties should review and agree upon the documentation, ideally signing and dating it. This agreed-upon record helps prevent disputes later on regarding the deposit refund.

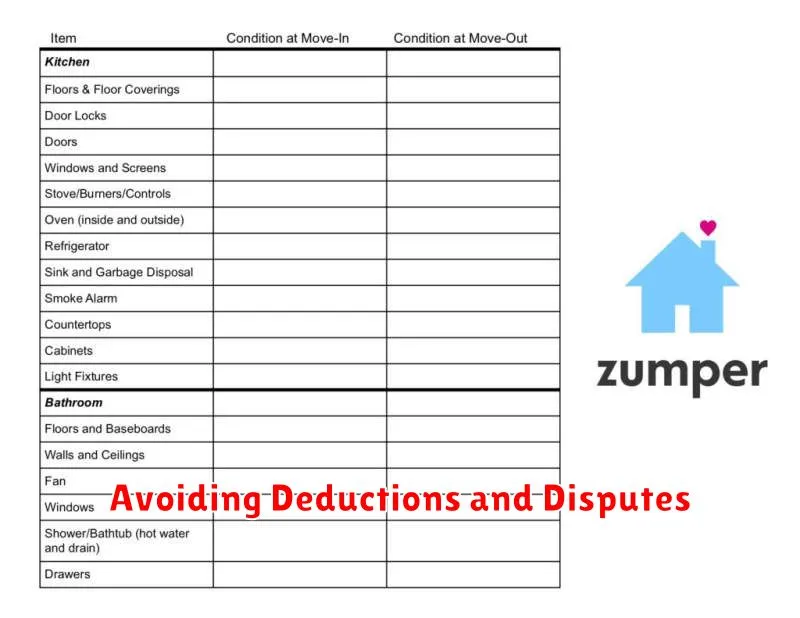

Avoiding Deductions and Disputes

Proactive communication and meticulous documentation are key to preventing deposit deductions and disputes. Clearly understand the terms of your lease agreement regarding allowable deductions. Regularly inspect the property and document its condition, ideally with dated photographs or videos. This record serves as crucial evidence of the property’s state at move-in and move-out.

Address maintenance issues promptly. Report any necessary repairs to your landlord as soon as they arise. This demonstrates responsible tenancy and helps prevent minor issues from escalating into costly repairs. Keep records of all communication and maintenance requests.

When moving out, ensure the property is thoroughly cleaned and returned to the condition it was in at move-in, less normal wear and tear. Review the move-out checklist with your landlord, if available, and document the property’s final condition. A joint inspection with your landlord at move-out is highly recommended to discuss any potential deductions openly and reach an agreement.

Timeline for Refunds

The timeline for receiving your rental deposit refund can vary depending on your lease agreement and local laws. Generally, landlords have a specific timeframe after your lease ends to return your deposit, minus any deductions for damages or unpaid rent.

Some states mandate a 30-day period, while others allow up to 60 days. Your lease should clearly state the timeframe. It’s crucial to review your lease thoroughly to understand your rights and the expected timeline. If the timeframe is not specified in the lease, refer to your local tenant laws.

Landlords are typically required to provide an itemized list of deductions. This list should detail the specific repairs or outstanding charges that are being deducted from your deposit. If you disagree with any deductions, you have the right to dispute them.

What If Deposit Isn’t Returned?

If your landlord withholds your security deposit, they must provide a written itemized list of deductions explaining why. This list should detail the specific repairs or cleaning costs deducted from your deposit. Review this list carefully. If you disagree with the deductions, it’s important to communicate with your landlord to try and resolve the dispute.

If communication fails, several options are available. You might consider mediation, a process involving a neutral third party who helps facilitate a resolution. If mediation is unsuccessful, you may need to pursue legal action, such as filing a claim in small claims court. The specific process and regulations for security deposit disputes vary by jurisdiction, so consult your local tenant laws for detailed information.